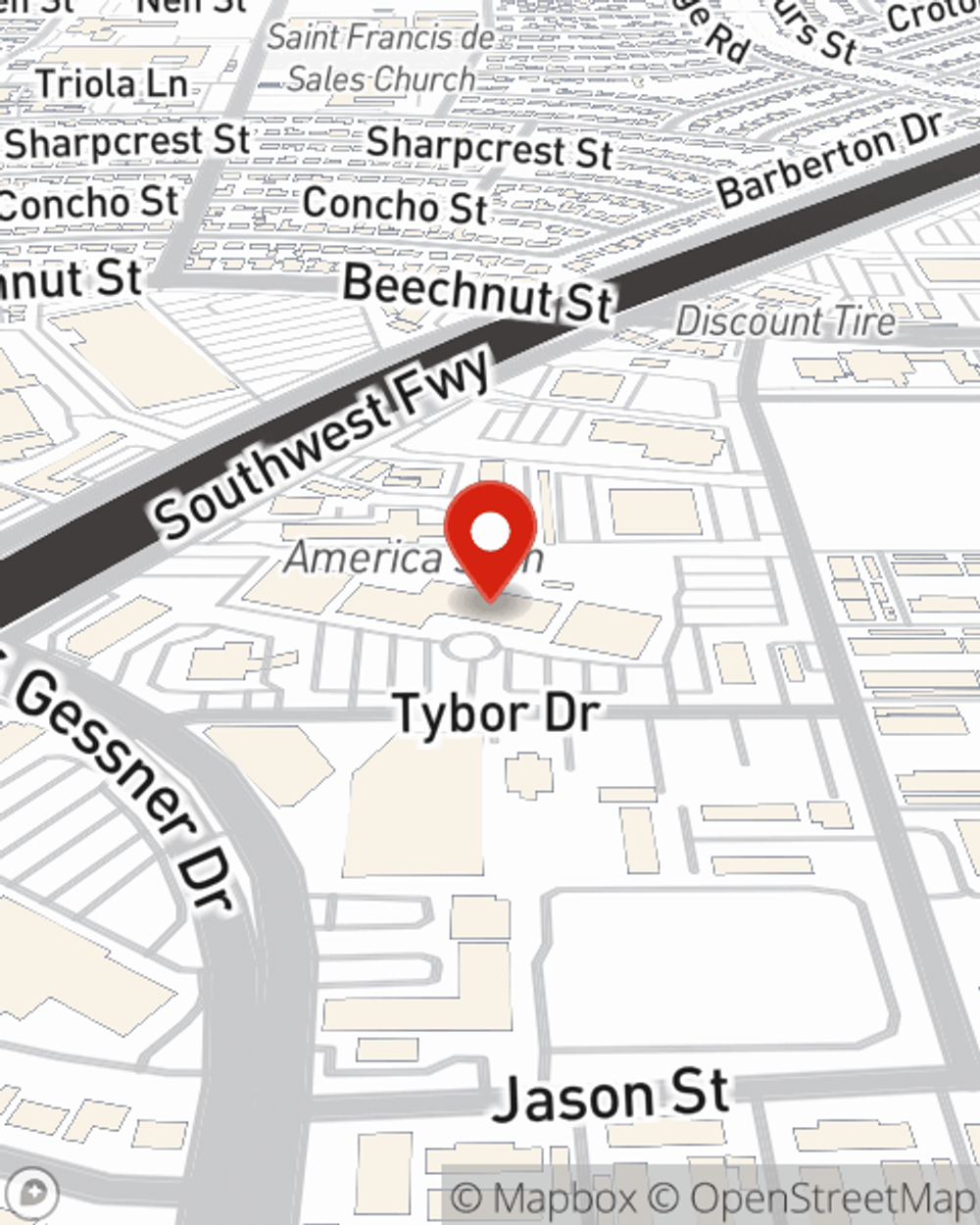

Business Insurance in and around Houston

One of the top small business insurance companies in Houston, and beyond.

Cover all the bases for your small business

Your Search For Remarkable Small Business Insurance Ends Now.

Do you own a travel agency, a confectionary or a hair salon? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

One of the top small business insurance companies in Houston, and beyond.

Cover all the bases for your small business

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, builders risk insurance or surety and fidelity bonds.

Let's discuss business! Call Chris Jones today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Chris Jones

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.