Renters Insurance in and around Houston

Looking for renters insurance in Houston?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

There's a lot to think about when it comes to renting a home - parking options, outdoor living space, price, condo or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Houston?

Coverage for what's yours, in your rented home

Why Renters In Houston Choose State Farm

When the unanticipated vandalism happens to your rented apartment or home, usually it affects your personal belongings, such as a coffee maker, a cooking set or a TV. That's where your renters insurance comes in. State Farm agent Chris Jones wants to help you understand your coverage options so that you can insure your precious valuables.

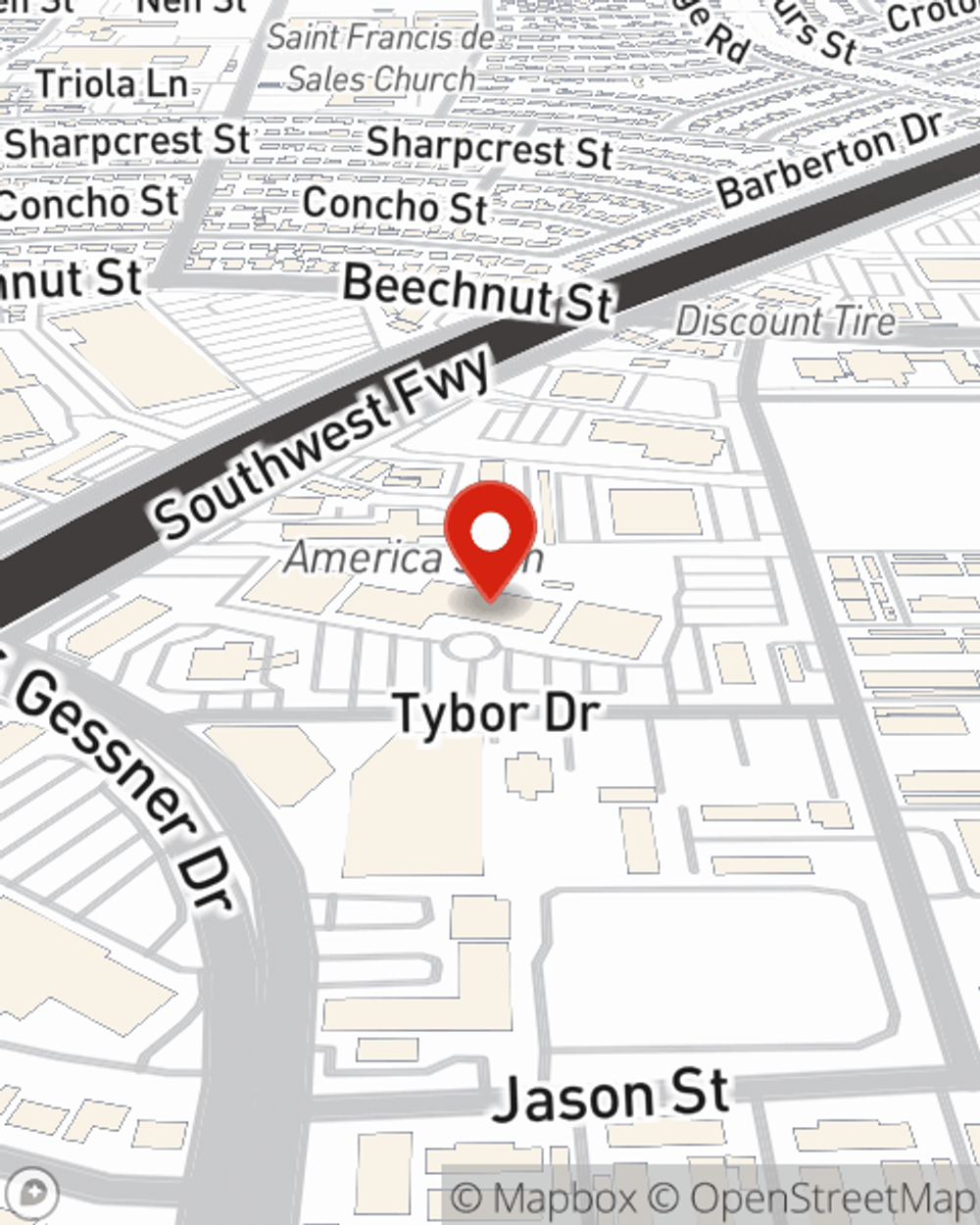

Renters of Houston, State Farm is here for all your insurance needs. Reach out to agent Chris Jones's office to get started on choosing the right coverage options for your rented townhome.

Have More Questions About Renters Insurance?

Call Chris at (713) 988-3333 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Chris Jones

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.